From Duff To Chuffed – Housing Boom On The Way

Glenigan is predicting an absolute boom in construction over the next two years, particularly residential, following a bit of a duff 2025. Revised...

Read Full Article

Glenigan is predicting a ‘phoenix moment’ for UK construction in 2026 with the sector set to fly high and away from the desperate 2025 downturn.

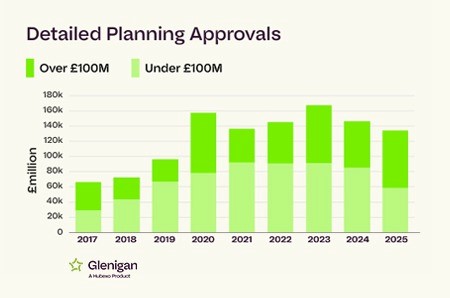

2025 saw an 8% decline in detailed planning approvals year-on-year; and 11% decline in main contract awards year-on-year; and a 20% decline in project starts against the preceding year-on-year.

Glenigan’s January edition of its Construction Review covers all major (>£100m) and underlying (<£100m) projects. Unfortunately, despite performance picking up pace in Q4 2025, it proved to be a disappointing year overall, with activity significantly down against 2024 levels and the values of projects starting on site slashed by a fifth.

There is little doubt for many across the sector that these lacklustre figures were the result of a perfect storm of domestic socioeconomic uncertainty and ongoing turmoil on the international stage along stubbornly high interest rates squeezing developers, contractors and subcontractors.

Commenting on the results, Glenigan’s economics director, Allan Wilen, says: “Once again, it feels like the industry has been stuck in a vicious cycle where any established momentum, as we saw in the residential market in the spring, suddenly vanishes sometimes due to the tiniest twitch upon a thread. Issues that under normal circumstances would be unremarkable, can have an immediate impact on confidence and activity, showing how fragile and sensitive the UK and global economy remain.”

Optimism

However, against this dim backdrop, Wilen remains optimistic for the year ahead. He continues: “Despite these poor results, we’re starting to see stability return, particularly a surge in non-residential work, noted in our most recent Index. Whilst it’s going to take a little time, the Chancellor’s Autumn Statement gave a far clearer funding commitment which will hopefully get shovels in the ground, plans approved and contracts awarded on a wide range of capital projects.”

2026 predictions

Housing, having shown so much promise at the outset of last year, took a massive hit after the increase in tax duty in April and continued to decline from there as high inflation delayed the lowering of interest rates. However, the 2026 forecast looks rosier with 6% growth predicted following the recent interest rates cut, further buoyed by the Social and Affordable Homes Programme.

Retail

Last year, performance fell across the board, mainly due to cost pressures from increased National Insurance contributions, minimum wage increases, high inflation and interest rates. These pressure cookers-worth of challenges have resulted in a flat forecast for 2026.

Health & Education

Health & Education also experienced declines in performance in 2025. However, in 2026, both verticals are expected to return to growth, with performance increasing by 4% and 15%, respectively.

Picture: Detailed planning starts were down in 2025 but are expected to improve greatly in 2026.

Article written by Cathryn Ellis

22nd January 2026