Glenigan Forecasts Construction Boom From 2025

Glenigan has released its widely anticipated UK Construction Industry Forecast 2025-2026 – which says project-starts will continue to strengthen as...

Read Full Article

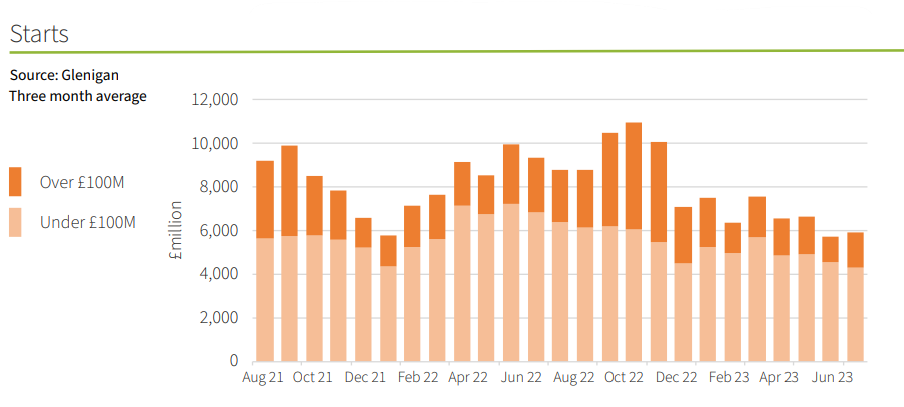

Glenigan, the business intelligence firm, has released the August 2023 edition of its Construction Review which shows that building starts are down a whopping 35% against this time last year.

The report focuses on the three months to the end of July. The central finding is that construction is slumping as the sector continues to be weighed down by a stalled economy. However, residential building starts are defying the overall trend and were on the up during the quarter of the survey.

Sustained external pressures continue to be the root cause of this disappointing performance. Rising interest rates and inflated material, fuel and labour costs have shown no signs of easing in the short-term, further weakening investor and consumer confidence.

This period covered showed project-starts dropped 10% against the preceding period of March-May.

These disappointing figures were echoed throughout the construction pipeline, with main contracts awards also falling back against the preceding three months (-24%) to finish 33% behind the year before.

Bright spot

One bight spot is that although detailed planning approvals fell 26% against the preceding three months, the value increased by 37% against the previous year.

Commenting on the findings in the August Review, Glenigan’s economic director Allan Wilen says: “Starts on site are softening and as global and national disruption continues, we’ll likely see clients continue to adopt a cautious approach, pushing back start dates until the economic landscape looks less hostile.

“Despite this, residential construction offers a glimmer of hope, with increases in private housing starts helping to offset sluggish activity in this sector vertical.”

Residential

Residential construction experienced an uptick, rising by a fifth (+21%) during the Review period, but remained 26% lower than a year ago.

Private housing starts increased 40% during the three months to the end of July but fell back 26% on 2022 levels.

Social housing starts were down 25% on the preceding three months and 21% on the year before.

Sector analysis

The health sector showed some signs of life, growing 23% against the preceding three months but remaining 25% lower than 2022.

Posting one of the worst performances, office project-starts suffered a 35% fall during the three months to July, with levels declining 50% against last year.

Similarly, industrial starts also fared poorly with their value slashed 24% against the preceding three months and 51% compared to the same period in 2022.

Hotel & Leisure starts declined 22% against the preceding three months and 41% compared to last year. Retail followed a similar trajectory, remaining flat against the preceding three months and standing 40% down on the year before.

Education & Community also crashed, dropping 34% and 36% against the preceding three months, to stand 7% and 40% down on the previous year, respectively.

Infrastructure

Civils work starting on-site crumbled, falling back 25% against the preceding three months to stand 46% down on a year ago. Infrastructure starts dropped 8% during the review period, finishing 45% on the previous year’s figures. Utilities starts also declined 43% against the three months to the end of July, finishing 49% down on a year ago.

Picture: Construction starts are down for the quarter and down for the year in most sectors.

Article written by Brian Shillibeer

24th August 2023